"Our employees have adopted Zip vendor cards so easily. That's where we've had the largest wins — because if our employees didn't adopt it, then we would be back to doing the whole payment approval process manually."

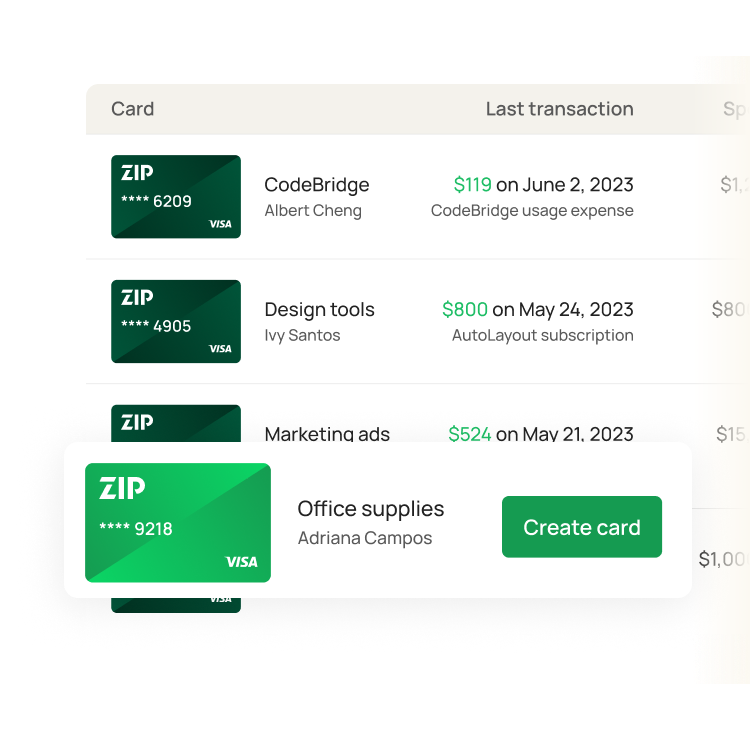

- Creating and managing vendor cards using legacy P2P system was labor-intensive, time-consuming

- Cumbersome card approval process required manual sign-off coordination and numerous follow-ups for receipts

- Previous payments system lacked an intuitive interface, creating barriers for employees to adopt and submit purchase requests effectively

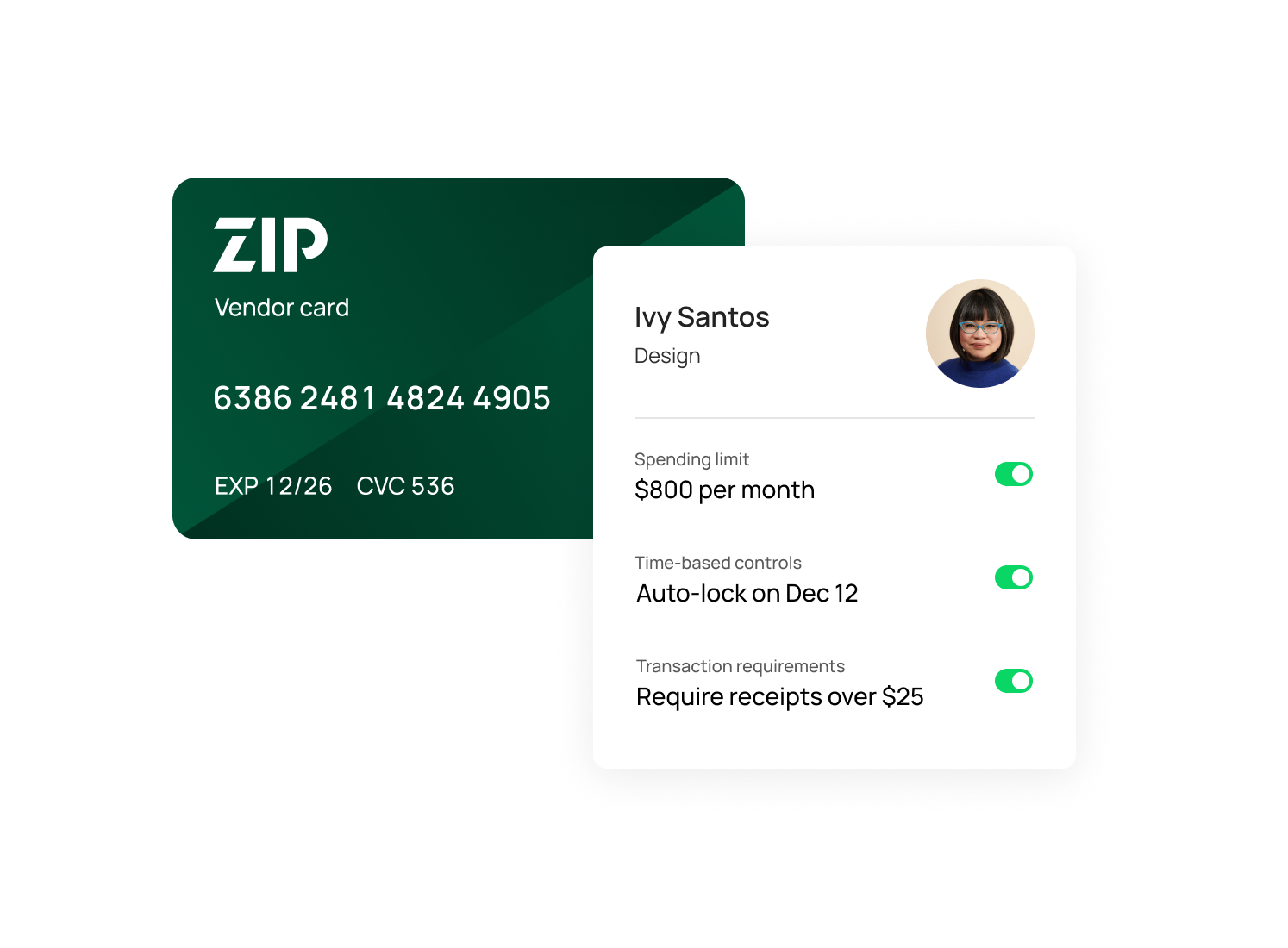

- Streamlined approach for creating vendor cards reduced process from 20–30 minutes per card to under 2 minutes

- Automated approval workflows removed the need for manual cross-functional coordination

- Detailed audit trail and time saved from intake allowed team to more deeply analyze spend and provide proactive insights to management

.svg)

.svg)