Accounts payable process: Your guide to efficient bill payments

Discover key steps and best practices of the accounts payable process with Zip.

The accounts payable (AP) process is rarely considered a particularly exciting workflow. However, getting a solid handle on your AP can unlock surprisingly powerful benefits for your business. Beyond simply avoiding late fees, an optimized AP process leads to stronger relationships with your suppliers, better management of your cash flow, and ultimately contributes to your company's overall growth.

This article is your guide to understanding the accounts payable process. We'll break down each step in plain language, highlighting best practices and offering actionable tips to streamline your workflow. Whether you're new to AP or looking to optimize your current system, get ready to discover how a well-oiled AP machine—especially when amplified by innovative tools like automation—can be a game-changer for your organization.

What is the accounts payable process?

The full cycle of accounts payable is an accounting process in which businesses manage and track payments made to suppliers for goods and services from the ordering process up until the payment. This process includes documenting all invoices, purchase orders, and other assets associated with the invoice approval and payment processes. It also requires tracking vendors' credit status and their payment history in order to ensure that prompt payments are made without any issues.

Accounts payable refers to the amount of money owed by a business or organization to its suppliers and creditors. This can include obligations arising from direct purchases (such as raw materials), services received (such as maintenance or IT support), and any interest charged by these entities. When the accounts payable department is fully aligned with the cycle, it is easier for companies to ensure a record of their financial commitments and assess when payments need to be made.

The accounts payable process is essentially the journey your business takes to pay its bills, from the moment you receive an invoice to the point the supplier gets paid. This process includes documenting all invoices, purchase orders, and other assets associated with the invoice approval and payment processes. It also requires tracking suppliers' credit status and their payment history to ensure prompt payments are made without any issues.

Accounts payable refers to the total amount of money your business owes suppliers who've provided you with goods or services. This covers:

- Direct purchases (such as raw materials)

- Services received (such as maintenance or IT support)

- Any interest charged by these entities

When your accounts payable team is in sync with the entire payment process, it makes it easier for your company to keep a clear record of all its financial promises. This also means you'll have a much better handle on when those payments are actually due, helping you stay organized and avoid any surprises like unexpected late fees or cash flow crunches.

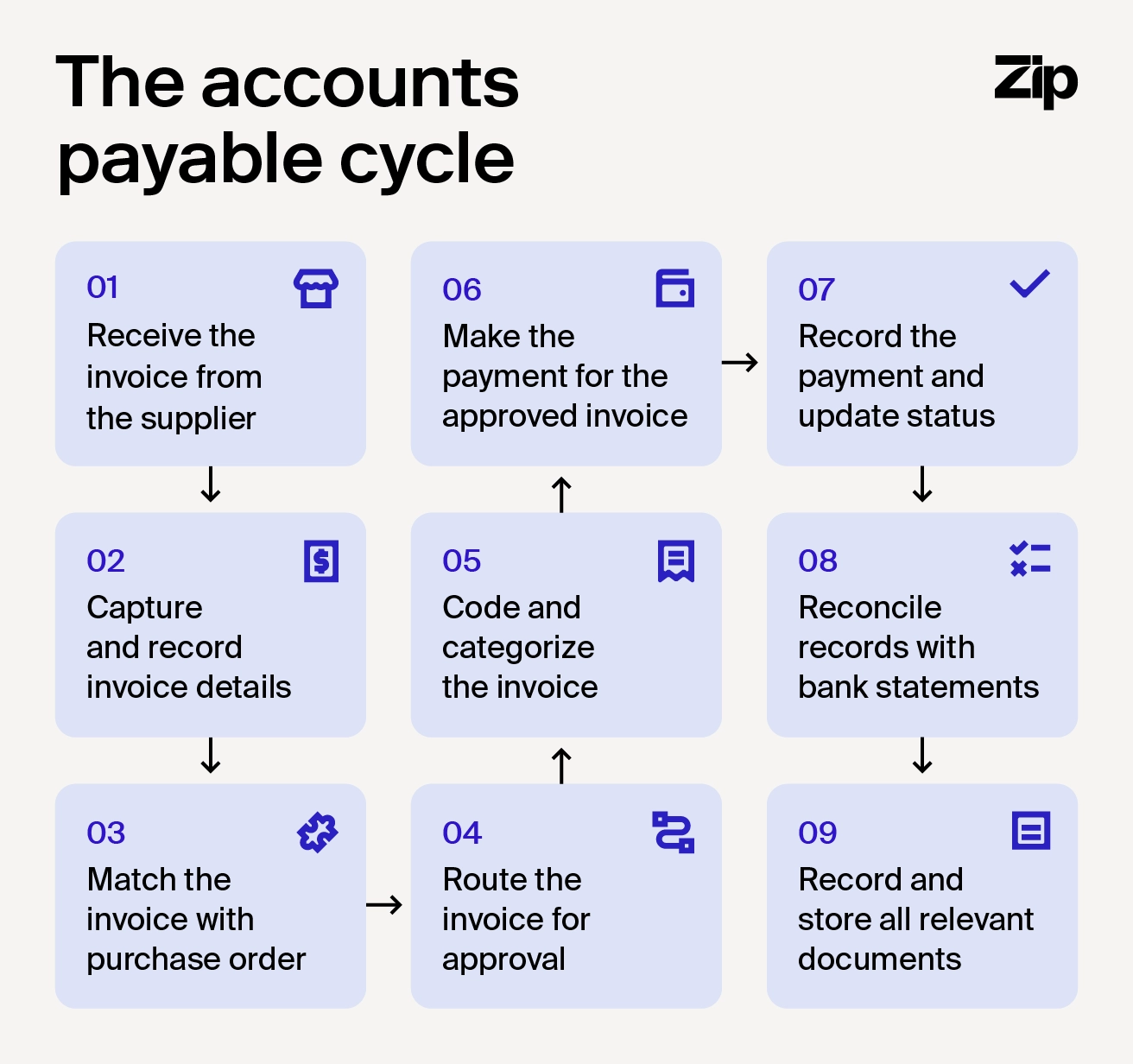

The full accounts payable cycle

The accounts payable cycle is the complete journey an invoice takes from the moment your business receives it until the payment is finally made and recorded. It's a systematic process designed to ensure accuracy, efficiency, and proper authorization for all supplier payments.

A smooth AP cycle minimizes errors, prevents fraud, and ensures timely payments, contributing to better cash flow management and stronger supplier ties.

Here's a breakdown of the typical steps involved in the AP cycle:

- Invoice receipt: The process begins when your company receives an invoice from a vendor, either physically or electronically.

- Invoice data capture: Key information from the invoice, like supplier details, invoice number, date, amount due, and payment terms, is recorded in your AP system.

- Invoice matching: The invoice is then matched against the corresponding purchase order (PO) and receiving report (if applicable) to verify that the goods or services were ordered and received and that the quantities and prices match. This is often referred to as the "three-way match."

- Invoice approval: Once the invoice is verified, it's routed for internal approval based on predefined rules and authorization levels within your organization.

- General ledger (GL) coding: The expenses on the invoice are assigned the appropriate codes to ensure they’re correctly categorized in your company's financial records.

- Payment processing: After approval, the payment is scheduled and processed according to the agreed-upon payment terms, which could involve checks, electronic fund transfers (EFTs), or other payment methods.

- Payment recording: Once the payment is made, it's recorded in the AP system, and the invoice status is updated to "paid."

- Reconciliation: AP records are regularly reconciled with bank statements and the general ledger to check accuracy and identify any discrepancies.

- Record retention: Finally, all related documents, including invoices, POs, receiving reports, and payment records, are stored according to your company's retention policies.

Accounts payable workflow process considerations

These days, most companies are turning to payment automation using tools like Zip to handle a lot of the heavy lifting. But before you jump in and let AI take the wheel, there are some important things to consider to make sure you get the most out of it:

- Bottlenecks and pain points: Before automating, really understand where the current slowdowns and frustrations are in your existing AP process. What tasks are taking the most time? Where are errors most likely to happen? Automating the wrong things won't solve your problems.

- Clear approval workflows: Automation relies on rules, so you need to clearly define who needs to approve which invoices and under what circumstances.

- Data accuracy and integration: Make sure the data you're feeding into your automated system is accurate. Also, consider how well the new AP automation tool will integrate with your existing accounting software and other business systems. Seamless integration is key for efficiency.

- Scalability: Think about your company's future growth. Will the automation solution you choose be able to handle a larger volume of invoices and more complex workflows as your business expands?

- User adoption and training: Even the best automation tool won't work if your team doesn't use it properly. Plan for adequate training and make sure the new system is user-friendly.

- Security and compliance: Accounts payable procedures deal with sensitive financial information. Make sure your chosen automation solution has robust security measures and helps you comply with relevant regulations.

- Supplier management: Consider how automation will impact your supplier relationships. Will it streamline communication and payment processes for them as well?

- Exception handling: No AP process is perfect. Think about how the automated system will handle exceptions or discrepancies, and ensure there's a clear process for resolving these issues.

- Reporting and analytics: A good automation tool should provide valuable insights into your AP process through reporting and analytics. Consider what kind of data you need to track and analyze.

- Cost and ROI: Evaluate the cost of the automation solution against the potential benefits, such as reduced processing time, fewer errors, and improved efficiency. Calculate the potential return on investment.

Best practices for effective accounts payable management

To truly optimize your accounts payable process flow and unlock its full potential, it's helpful to look at some proven strategies. Implementing best practices can significantly improve efficiency, reduce errors, and strengthen your financial controls. Let's explore some key approaches that can elevate your AP management.

Establish clear policies and procedures

To keep your accounts payable running smoothly and accurately, it's a good idea to create a clear and easy-to-follow manual. This manual should outline the roles and responsibilities of each team member, as well as the standard operating procedures for each stage of the accounts payable cycle. Your go-to AP guide should be easily accessible and regularly updated to ensure consistency and adherence to best practices.

Maintain strong supplier relationships

Having a go-to person for each of your suppliers is like having a direct line—it makes communicating easy and keeps everyone on the same page. This helps build trust, sorts out any hiccups quickly, and makes sure you're getting the right info when you need it.

When it comes to paying, try to find terms that work well for your company's cash flow while also taking into account the financial health of your suppliers. Pay invoices on time (or even a bit early!) to foster goodwill and potentially earn yourself some early payment discounts or other favorable terms down the road.

Regularly monitor accounts payable performance

Keeping a close eye on how your accounts payable process is performing using key performance indicators (KPIs) is a smart move because it gives you a clear picture of what's working well and what could be better.

Regularly tracking things like how long it takes to process invoices, how often you're paying late, and the accuracy of your payments helps you spot potential problems early on. This allows you to make timely adjustments, improve efficiency, strengthen vendor relationships by ensuring timely payments, and ultimately contribute to better financial health for your organization.

Ensure staff training and development

Investing in regular training and development for your AP team equips them with the knowledge and skills needed to navigate the complexities of the process accurately and efficiently. Well-trained staff are more likely to:

- Understand internal policies

- Utilize technology effectively

- Identify potential risks like fraud

- Maintain strong communication with suppliers

This results in fewer errors, faster processing, better compliance, and a more skilled team for a stronger AP function.

Implement strong internal controls

Effective internal controls act as the smart locks and security cameras for your accounts payable process. They're the checks and balances you put in place that include things like:

- Segregation of duties

- Dual approvals

- Authorization limits

- Controlled access

- Invoice number tracing

- Designated check signers

- Regular reconciliation

- Vendor verification

- Periodic internal audits

These rules help prevent mistakes, catch anything fishy like fraud, and keep things running smoothly and honestly. This not only protects your company's money and assets but also gives everyone more confidence in your financial records.

It's also wise to have a disaster recovery plan in place that outlines how you'd keep your essential AP functions running if something unexpected happens, like a system outage or a natural disaster. This ensures business continuity and prevents major disruptions to your payment processes.

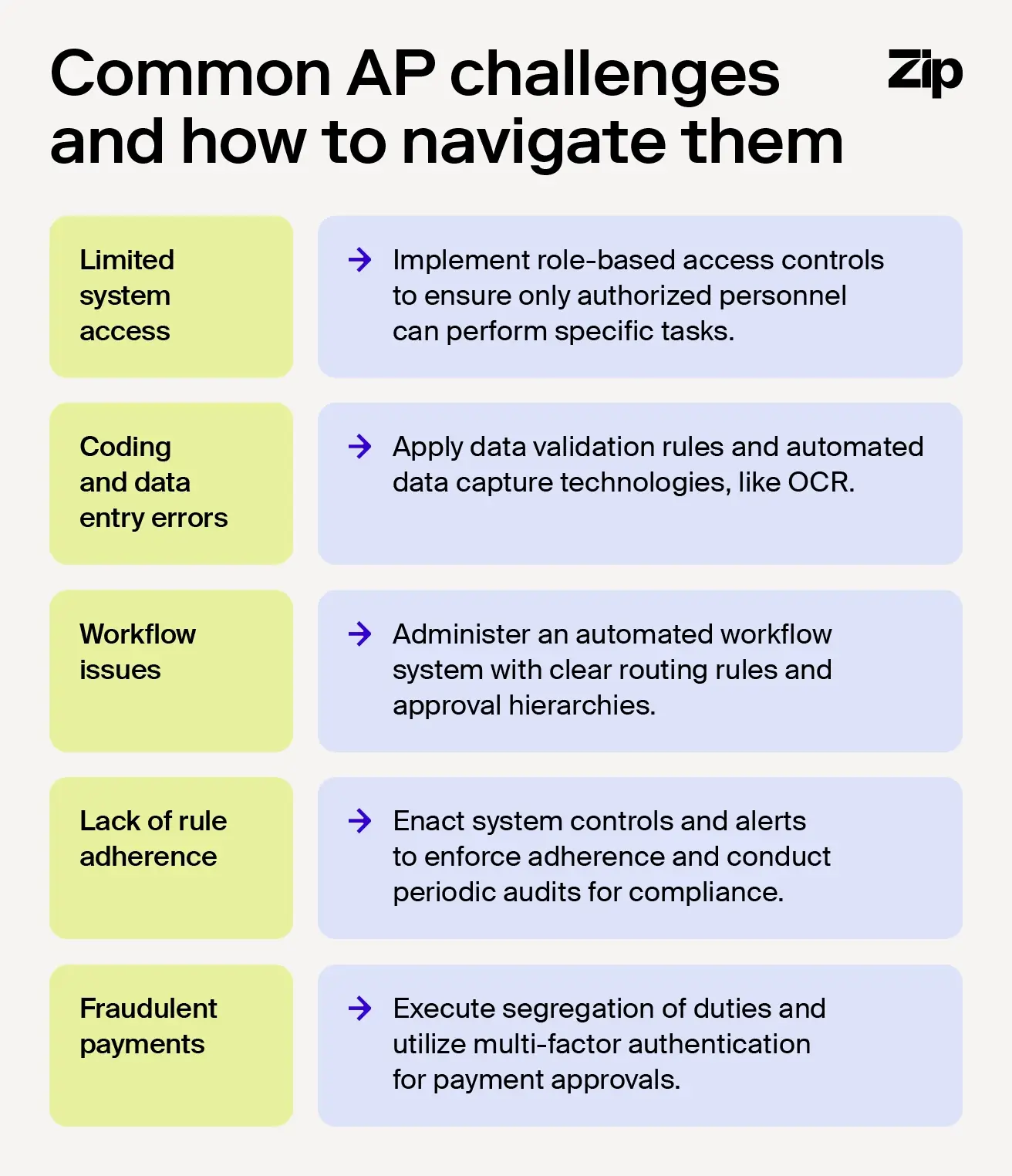

Challenges in the accounts payable process

Even with the best intentions and well-defined processes, the accounts payable department can face its fair share of hurdles. From manual tasks that eat up time to the ever-present risk of errors and fraud, understanding these common challenges is the first step toward overcoming them and building a more resilient AP function.

Let's take a look at some of the typical pain points in the accounts payable process.

- Limited system access: When team members who need to interact with the accounting system don't have the right access, it can create bottlenecks and slow things down. This lack of access can lead to delays in approvals, difficulty tracking invoice status, and overall inefficiency.

- Coding and data entry errors: Mistakes happen, but incorrect coding or simple data entry errors when processing invoices can lead to serious problems. These errors can result in paying the wrong amounts, miscategorizing expenses in your financial records, and ultimately causing financial inaccuracies.

- Workflow issues (approvals and unlinking): Problems like improper approvals or unintentionally unlinking important documents within the payment workflow can create chaos. This can lead to unauthorized payments, missed approvals, and a breakdown in the checks and balances you need for accurate processing.

- Lack of rule adherence: If established AP rules and procedures aren't consistently followed, it opens the door to a wide range of errors and inconsistencies. This can make it difficult to maintain control over the process and increases the risk of mistakes and even fraud.

- Fraudulent and unauthorized payments: The threat of fraud is a serious concern. Without strong security measures and vigilant monitoring, organizations are vulnerable to financial losses and reputational damage.

Successfully navigating these specific challenges through robust controls, proper training, and automation is key to maintaining a healthy and efficient accounts payable function.

Discover how to automate the accounts payable process with Zip

Your accounts payable team is right in the middle of handling your company's bills and keeping your suppliers happy, so making sure things run smoothly is essential for keeping your cash flow healthy, your finances in order, and building those long-term relationships with the folks you buy from. But when AP is stuck doing things manually, it can slow things down and make it tough for your business to scale.

Zip AP automation goes beyond just making things run smoother—companies like Dollar Tree and Canva have found it to be the solution to boosting their financial management and team efficiency. By letting AI handle invoice processing, expedite AP approvals, and automate payments, you'll see faster turnaround times and fewer mistakes while gaining visibility into every AP transaction.

Request a demo today and discover how Zip can simplify your AP process and set you up for better financial health and smoother operations.

Accounts payable process FAQ

Still have questions about the accounts payable process? This section addresses some of the most frequently asked questions to help clarify key concepts and provide quick answers.

What’s the difference between accounts payable and accounts receivable?

Accounts payable is the money your company owes to others for things you've bought on credit, like supplies or services. It's a liability—money going out.

Accounts receivable (AR), on the other hand, is the money that others owe you for goods or services you've provided on credit. That's an asset—money coming in. So, AP is about your bills, and AR is about your invoices waiting to be paid.

What is a three-way match in accounts payable?

A three-way match in accounts payable is the process of verifying an invoice by comparing it to the purchase order and the receiving report to ensure the details (like quantities and prices) align before payment is processed. It's essentially checking that what you originally ordered is what you actually received.

How does AI improve the accounts payable process?

AI is making big waves in accounts payable by automating many of the most time-consuming and error-prone tasks. For example:

- AI-powered systems can automatically read and pull information from invoices, no matter the format, which cuts down on manual data entry.

- These systems can also match invoices with purchase orders and receiving documents super quickly and flag any discrepancies for review, helping to prevent overpayments and fraud.

- AI can learn your company's approval workflows and automatically route invoices to the right people, speeding up the whole process.

- It can help with things like figuring out the correct accounting codes and spotting unusual payment patterns that might indicate fraud.

Ultimately, AI aims to make the AP process faster, more accurate, and less of a headache for everyone involved, freeing up your team to focus on more strategic work.

Maximize the ROI of your business spend

Enter your business email to keep reading

.webp)

.avif)